[ad_1]

Like bankers in 2008, insurers risk becoming the bad guys in the COVID-19 pandemic.

As thousands of UK small businesses – facing empty city centers, absent staff and mandatory closings – have turned to them for help, insurers have folded back on their pandemic exclusions. In response, the FCA ultimately took a business interruption (BI) test case to the Supreme Court, winning a decision with potential impact on 370,000 policyholders for the best.

What matters here are not the technical merits of the insurers’ case – and they are certainly real, as it’s hard to imagine exactly how insurers might foot the bill for an event like COVID-19. The simple truth is that the BI controversy has further damaged the image of the industry, an image that was hardly in the right place to start.

Consumer animosity towards the industry is well documented. Insurers are seen to be making their money by denying claims and penalizing loyal customers with higher renewal prices – recently the subject of another FCA intervention, following a Citizens’ super-complaint ‘Advice Bureau. Add to that endemic concerns about data privacy, and you get a good picture of the low-tier insurers that a large chunk of the public currently enjoys.

In the past, this kind of brand damage could have been ignored. After all, the insurance industry hasn’t survived more than three centuries with thin skin. However, bad reputations really hurt insurers. Even as we move into what some have touted as the “post-brand era” – an era of total commodification – the brand is more important than ever.

Why the brand is the backbone of digital change

We hear – and indeed say! – much on the need of insurers to transform digitally: to offer customers a personalized service on the device of their choice, via the channel of their choice, 24 hours a day, 7 days a week. But it’s all driven by customer data, which is a potential source of friction.

Insurers of course get closer to customer data – through APIs and Open insurance for example, but that doesn’t quite get them to the end.

Even though sharing data is as easy as a click, customers still need to give consent, they still need to trust the security of the process, and they need to be confident that in return they will receive the personalized service they are promised. . The mark will always be the last mile to the last mile – like a closer deal if nothing else.

When customers don’t trust a vendor, they’re less likely to share their data. This in turn limits the ability of this vendor to develop and deploy next-gen personalized services, as those services are driven by data, customer engagement, and rapid iteration.

The brand can therefore become the hidden superpower of companies as they fight for a data-driven advantage. And the amount of trapped demand for data-driven services in insurance will only increase, as consumer appetite increases as consumer confidence in data sharing declines:

Source: Reinventing UK insurance for today’s consumer, 2021

Our recent consumer study, Reinventing insurance in the UK for today’s consumer, shows a 16 ppt increase from 2018 to 2020 among UK consumers who ‘would share important data on health, exercise and driving habits in exchange for lower insurance rates’. Meanwhile, the share of consumers who “place great trust in insurers from a data privacy standpoint” has fallen by 11 points. We end up with a growing “trust gap”.

Digital transformation, as always, involves digital technologies. But it’s through a brand that insurers will get the most out of their digital investments – bridging the trust gap and unlocking customer data to power the next generation of digital services.

So what makes a strong insurer brand in the data-driven age? Two things: the purpose and the delivery.

Technology Vision for Insurance 2021: We outline five emerging technology trends that will impact the insurance industry in 2021 and beyond.

Goal-driven insurance brands

Once upon a time, consumers expected products to do what they said on the tin, and insurers existed to provide one thing: insurance coverage. Nowadays, when shopping, customers buy more than just a product, they are buy in a set of values - a social, environmental or lifestyle goal. By reflecting these values, through actions rather than words, insurers can earn the trust of future generations of buyers.

Insurers are no strangers to lifestyle values, as these have a direct impact on risk, especially in health insurance. Social and environmental values, on the other hand, are less linked to risk, but that does not prevent them from weighing heavily on customers’ purchasing decisions.

By being socially and environmentally responsible organizations, insurers can avoid negative public relations and the accompanying consumer penalty. In addition, they can actively grab the attention of ESG-conscious clients with targeted products, both on the underwriting and investment side.

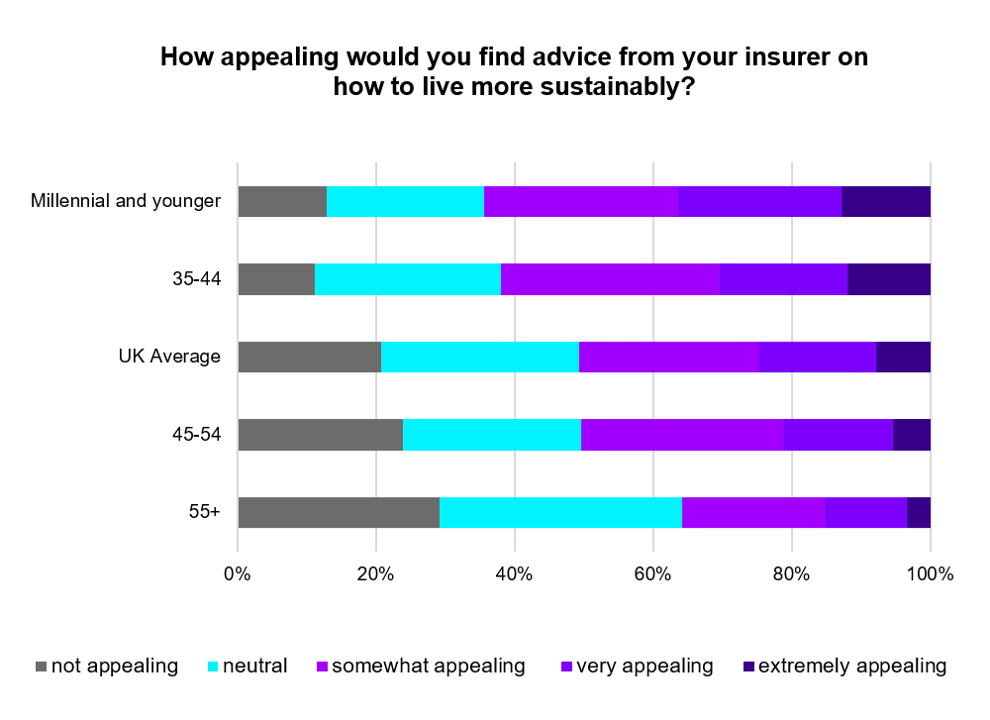

For starters, insurers can use their investment pool wisely, for example by financing sustainable real estate, or offer green investment products directly to clients. They can also buy into the green economy – things like solar and wind farms – or provide social insurance, including programs to protect financially vulnerable people. We even find an appetite among consumers – especially the younger generations – for advice on sustainable living:

Source: Reinventing UK insurance for today’s consumer, 2021

Some of these ESG-focused opportunities may seem small on their own, but it needs to be understood in the larger context of doing business in 2021: a context in which companies offer and customers have, and a bit of improvement. of the brand can do a lot.

Bad brands promise, good brands deliver

Goal-driven brands grab consumers’ attention and approval, but is it the same as gaining their trust and, with it, the ability to deliver more data-driven personalized service?

Basically, trust is built on experience. You trust a lock that has never failed, just like you trust a friend who has never let you down. As long as customers get low value from sharing their data – or worse, poorly personalized experiences – insurers will not gain confidence, no matter how well their broad values align.

The mismatch between promise and delivery in insurance is even deeper. Policies are complex and clients are rarely insurance experts. Often times, the coverage they think they have is not the coverage they actually get. This means that, even when insurers have legitimate grounds to deny a claim, many claimants feel cheated and suspicious, as we saw in the recent BI controversy.

To combat this, insurers need to promote a better awareness of what a policy covers and what it does not. A multi-layered communication strategy – involving easily digestible web content, chatbots, and customer service agents – can lead to better customer education, fewer denied complaints, and higher levels of trust.

New FCA rules prohibiting double pricing are the added wind in the sails of brand-conscious insurers.

By its very nature, dual pricing is a misalignment of promise and delivery – and therefore kryptonite to customer trust. They wake up from the dream of integrating discounts – too good to be true, one might say – with the bitter reality of renewal rates. And insurers have only been urged to maintain this sad misalignment, since such fierce price hikes for loyal customers are precisely what funds the fierce competition for new business.

In this sense, the insurance market has become a mistrust machine, with insurers effectively selling long-term reputations for short-term benefit. The FCA’s decision reverses this dynamic: rather than competing on the toxicity they can endure, companies will instead be rewarded for actively cultivating a good reputation. And it is those who took care of their brands who are now one step ahead.

So maybe the insurers aren’t the bad guys after all. At least it doesn’t have to be. As so often argued, the industry has a chance to radically transform the role it plays in the lives of consumers. But that won’t come primarily from technology. First and foremost, it’s about doing the essentials well: creating a goal and keeping promises. In a world obsessed with digital innovation and digital innovators, good old-fashioned brand strength may still prevail for incumbents.

To learn about the latest UK insurance consumer trends and how providers can make every part of their business serve the customer through a business of experience approach, download our new report, Reinventing insurance in the UK for today’s consumer. If you would like to contact us or discuss any of these ideas further, please reach out to me.

Get the latest insurance industry information, news and research delivered straight to your inbox.

[ad_2]

Source Link